Tips for Saving Money Part 2 – Adapting your Lifestyle*

Yesterday I posted the first in this two part series about saving money, that was about ways around the home to save money, today I’m looking at changes you can make to your lifestyle to save money. Yes, this isn’t for everyone.. at the end of the day it’s all about taking a good look at what you’d prefer to get out of life. For me the most important thing at the moment is taking my daughter on wonderful adventures, that’s my priority. If yours is going out partying every Saturday night, you won’t be able to manage to save for a Florida holiday if you’re on a low income, simple as that. In this day and age, unless you’re super rich, you really can’t have it all especially when you’re a parent.

I wouldn’t say I lived a frugal lifestyle, but I do know where I can appropriately cut corners which is what I’m sharing with you all today.

Coupon Coupon Coupon.

I know some people get embarrassed about the idea of standing in the shop with a handful of coupons but there really isn’t any need to be. Every little helps. Stores such as Tescos actually send out coupons for you to use to save yourself money. Never forget they’re a big company, it’s better the extra savings are in your pocket not theirs. Sometimes I even purposely only buy what I have coupons for even if it’s a brand I’m not used to. This is the same as buying what is on offer rather than what you always buy. I switch brands around all the time to ensure I get the best for the best price.

Wait until it’s on sale.

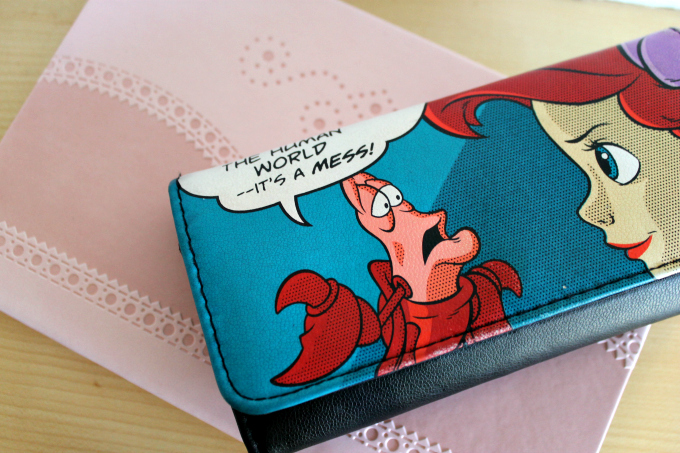

When it comes to shopping for big occasions like birthdays or Christmases I start shopping as early as the summer midseason sales. Why? Normally I have more money then and you can find lovely things that are cheaper. I placed a Disney Store order on Tuesday and picked up two jigsaws for less than £5. I usually buy all my gift wrap and cards in the boxing day sales and just pop it in the Christmas box that comes out the loft at the end of November. It’s not like gift wrap or cards go in and out of fashion and I’d rather buy them when they’re at their cheapest.

If you smoke, switch to an ecig.

I don’t smoke, but I have had ex boyfriends who did in the past and the amount of their wages that went on cigarettes was unreal. But now there is something that is more cost saving. Switching to an e-cig can save you over half what you’d spend on cigarettes and it’s a lot better for you health wise if you still struggle with the prospect of giving up completely.

Save your store points for outings.

As I mentioned in my post about funding a single mother’s lifestyle, for outings I save points such as Nectar or Clubcard. These days you can use them on things such a train travel, Eurostar and even airfares.. as well as for meals out and cinema trips. I have used mine to pay for a ticket to Thorpe Park in the past and Legoland. I never ever spend mine store because if you spend them else where they’re usually doubled or even tripled. It makes a day away so much cheaper and more doable in the long run meaning Little Miss doesn’t need to miss out because I’m saving hard for a holiday.

If you shop online, sign up to a cashback website.

This is something I was only recently introduced to by Emma of Not Your Average. You can buy things online through this website and receive cashback on it. This works for big purchases and small purchases, but obviously the more you spend the more you get back. I wish I’d known about it when I bought my iPad and camera last year as it could have saved me hundreds. Now I use it for most of my online purchases even for small things such as DVDs or books. Again, it doesn’t seem like a lot but for an extra few clicks it means more money in your pocket than theirs and it soon adds up.

Buy second hand.

As I mentioned in yesterday’s post, I try to buy a lot second hand. Not just clothes and toys. If you are looking for a car, why not try buying second hand? There are so many safe ways to pick up a second card these days, you don’t need to worry about getting a dud. Also, second hand furniture.. so good especially if you have little ones. I think the majority of my furniture is from second hand furniture stores.

Keep an eye on Voucher websites.

Another one, before I make an purchase I always search for a voucher code. Sometimes you can get ones that you print off and use in store too. Even if it’s something as simple as free delivery.. I’d rather I didn’t have to pay it if I can find a way around it. There are so many of these websites now, don’t be content with just checking one.

And finally, keep track of your spending.

Although I said I wouldn’t be sharing my in depth saving spreadsheet, I will say this. Make sure you make a note of everything you spend then at the end of the month work out how much of it was unnecessary and try the following month to beat the frivolous spending score. I love getting things in the post but by the end of the month when I look at all the crap I’ve bought I usually feel so guilty that I work harder the next month to not do that. It feels good at the time but in the long run, I know I’d rather have that extra cocktail on holiday to celebrate all the money saving I’ve accomplished.